StormGain Review: A Solid Platform for Leveraged Crypto Trading

StormGain is a crypto exchange where traders who want some serious leverage can trade in the world’s most popular cryptos. There are numerous crypto exchanges to choose from, but StormGain offers unique features that set it apart from the pack.

Cryptocurrencies have become more popular, but many crypto exchanges simply don’t offer normal trading tools like limit orders. StormGain created a fully-featured trading platform that goes well beyond simple trades.

The use of leverage is becoming more common in the world of crypto trading. Not every leveraged crypto trading platform is created equal. Some are confusing to use, and other platforms can be very expensive to use.

StormGain offers some of the best rates on leveraged crypto trades, as well as a full suite of trading tools. It also has some pretty sweet extras on offer, as well as easy account opening.

StormGain Has Advanced Tools for Serious Traders

Successful trading takes the right tools for the job. StormGain built a great toolset into its trading platform, and also included some extras that you won’t find anywhere else. The platform is made for traders who want to use leverage and can take advantage of a professional-level too set.

StormGain is based on trading crypto derivatives that are secured by the deposit on USDT in a client’s account. Basically, all a trader has to do is deposit 50 USDT into their account, and they will be able to leverage that amount by up to 100 times.

The use of leverage does increase the risk of loss, but it also magnifies any gains from a trade. StormGain has a minimum trade size of 10 USDT, which could be leveraged to 1000 USDT worth of cryptocurrency.

High levels of leverage can be dangerous for inexperienced traders, and solid risk-management strategies are needed to stay solvent.

StormGain Registration

KYC regulations are a great thing for the crypto industry, Unfortunately, many crypto exchanges have lost customers because they simply have to turn away people for regulatory reasons. StormGain is easy to open an account with, and they only require their clients have an email address, and a minimum deposit of 50 USDT.

The registration process at StormGain is extremely simple. Just visit the website, enter your email address and a password for the new account, and then make your USDT deposit. You can be trading with as much as 100x leverage at StormGain in less than 24 hours.

StormGain Deposits & Withdrawals

Deposits and withdrawals are easy within Stormgain, simply choose your required asset and send fund to the wallet address.

StormGain Fees

In addition to easy account opening, StormGain has low fees for crypto trading. Depending on the crypto you choose to trade, StormGain charges between 0.15% and 0.5% for the position. StormGain’s fees are in-line with other leading crypto exchanges, and leave lots of room for profits.

Instant Exchange Fees

InstrumentMin Exchange SizeCommissionBCHBTC0.00000001 BCH0.25%BCHUSDT0.0001 BCH0.08%ETHBTC0.000000001 ETH0.25%LTCBTC0.00001 LTC0.25%BTCUSDT0.00001 BTC0.08%ETHUSDT0.0001 ETH0.08%LTCUSDT0.001 LTC0.08%XRPUSDT0.1 XRP0.08%

StormGain reference T&CInstrumentMax MultMin MultCommission

(avg.)Swap Buy

(daily rate)Swap Sell

(daily rate)BTCUSDT10050.15%-0.04%0.004%ETHUSDT5050.15%-0.04%0.004%LTCUSDT5050.15%-0.04%0.004%XRPUSDT5050.15%-0.04%0.004%BCHUSDT5050.15%-0.04%0.004%ETHBTC5050.25%-0.04%-0.04%LTCBTC5050.25%-0.04%-0.04%BCHBTC5050.25%-0.04%-0.04%DSHBTC5050.25%-0.04%-0.04%

Crypto deposits/withdrawalsCurrencyDeposit feeWithdrawal feeMin.amount of

depositMin.amount of

withdrawalBTC0.00%1%0.005 BTC0.00 BTCBCH0.00%1%0.160 BCH0.00 BCHETH0.00%1%0.200 ETH0.00 ETHLTC0.00%1%0.550 LTC0.00 LTCXRP0.00%1%160.0 XRP0.00 XRP

StormGain Trading Platform

Like most crypto exchanges, StormGain designed their own platform. It features limit orders, like stop-loss and take-profit orders, as well as other useful tools.

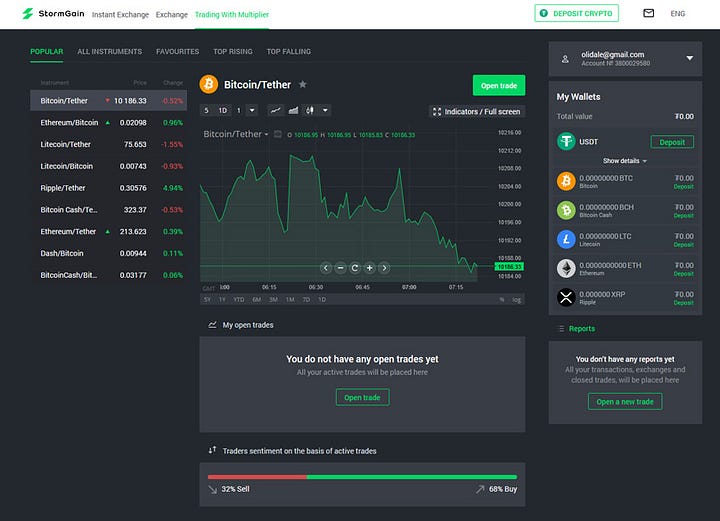

As you can see here, StormGain has one of the best looking trading screens we have seen, latest prices are shown on the left with the selected trading instrument displayed in the center with and your wallet balances to the right. Below the main chart is where your trades are shown and below that is a handy sentiment guage which shows active trades on the buy and sell sides.

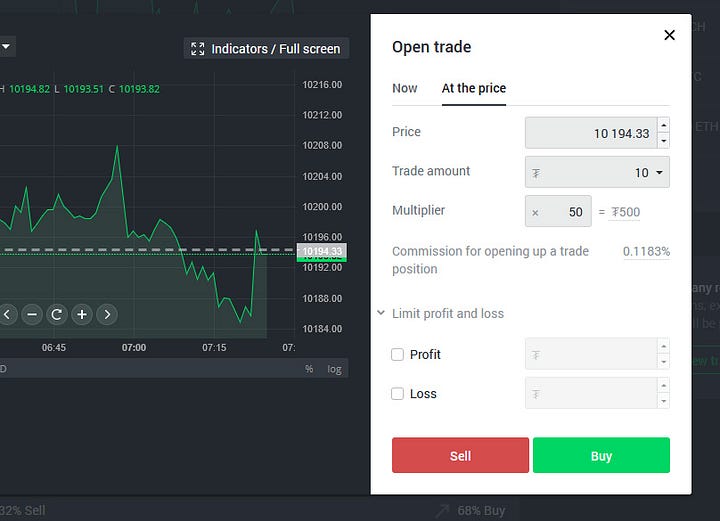

To make a trade, simply click the “Open a New Trade” button and you can place it in the modal window which opens. Here is where you can use leverage and also set a stop loss etc.

StormGain built trade signals into its platform, which is unique. An advanced AI algo will help StormGain clients to stay aware of any opportunities that arise with automatic trade alerts. Many third-party algos exist, but most of them cost something to use.

There is also a fully-featured mobile app for StormGain clients that allows them to use the platform from any Android or iOS device. The app is totally free, and will also deliver market alerts and interactive charts.

StormGain Wallet

StormGain is offering a very capable crypto wallet for free. If you are looking for a crypto wallet that is connected to a high-leverage exchange, the StormGain Wallet is worth a look. In addition to a direct connection with the StormGain exchange, the StormGain wallet allows users to send and receive crypto directly, with some of the best security features around.

The StormGain wallet supports all of the major cryptos, and doesn’t transfer ownership of the private keys to StormGain. All you have to do is go to the wallet section of the StormGain website to download the free wallet and complete the registration process.

Stormgain Leveraged Crypto Trading

StormGain offers anyone who wants to hold cryptos, or trade them with leverage a lot of functionality. In addition to offering traders 100x leverage on Bitcoin, Bitcoin Cash, Ethereum, Ripple, and Litecoin, it also gives traders industry-standard tools to make great trades.

Crypto-specialist brokers like StormGain a probably a much better choice for crypto leveraged crypto trading than their fiat CFD broker counterparts.

Many of the world’s largest CFD brokerages are now offering leveraged crypto trading, but the terms that traders are offered vary widely between brokers like StormGain, and fiat-centric CFD brokers.

The volatility in the crypto markets makes them a perfect place for leveraged trading. StormGain designed a platform that allows traders to start quickly, and without loads of money. While the company is new, the feature set they created is very capable.

It is very important to learn how to manage risk if you plan to use leverage to trade in any market. StormGain offers traders all the tools they need to stay safe and make big profits when the market moves in their favor.

Any trader who is looking for a way to use more leverage in their trading should review all the features that StormGain offers, and decide if it is the right exchange for their needs. There is no doubt that StormGain offers a unique service that many crypto traders will likely find useful.

Leveraged Crypto Trading is a Specialist Market

Numerous major CFD brokers have entered the leveraged crypto trading market, but most don’t offer the kind of terms that StormGain delivers to its clients.

Before deciding on a broker for leveraged crypto trading, it is a good idea to dig into the specifics. Most of the fiat CFD brokers simply won’t offer high amounts of leverage on crypto products (even if they offer 100x+ leverage on other markets).

Most CFD brokers also limit funding to fiat options. For crypto users, this isn’t ideal, which is why choosing brokers that accept tokens like USDT makes a lot of sense.

The ease of account opening is another big plus with StormGain, and just about anyone who has some crypto holdings will be able to come up with USDT via another crypto exchange. When it comes to terms, cost, as well as flexibility, StormGain has most fiat CFD brokers beat for crypto trading.

Leverage and Limit Orders Work Together

Trading with leverage is riskier than using a 100% funded cash position. StormGain added limit orders to its platform, and that makes high leverage trading a lot safer. The two most common types of limit orders are stop-loss and take-profit, and StormGain built both of them into its platform.

Stop-Loss Orders

Using leverage means that a trader is using a multiple of their capital to maintain a position.

For example, using leverage of 5x means that a trader is using five times the amount they have in their account to trade. If the trade goes their way, the profits will be five times higher, but the reverse is also true.

Whenever a leveraged trade is opened, it is a great idea to have a stop-loss order in place. Using leverage without a stop-loss order is dangerous, and could lead to losses that exceed the amount of money in a leveraged trading account.

Take-Profit Orders

It doesn’t take much good luck to double your money with leveraged trading.

When a leveraged trade goes in the way a trader hopes, the gains add up quickly. The problem is, markets can be volatile. By the time a trader gets back to the trading platform, the big gains from a leveraged crypto trade may have come and gone.

Take-profit orders are like the opposite of a stop-loss order.

When a trade is opened, it is a very good idea to have some idea of what level will make sense for profit-taking. If a trader used 100 USDT to open up a 50x leveraged position in BTC at $6,000 (total of 5,000 USDT worth of BTC, or 0.833 BTC), the price of BTC would only have to rise to $6,145 for the trader to double their investment.

By placing a take-profit order at $6,150 for BTC when the trade is opened, a trader would ensure they would be making a stellar trade if the market goes in the direction they think.

Some crypto exchanges don’t support limit orders, which means that losses can easily run out of control, and potential gains can go unrealized!

Is Leveraged Crypto Trading Right for You?

Leveraged trading can be a risky activity, and it isn’t going to be a good fit for every trader. There are some important things to consider before you decide to use leverage, even with a reputable broker like StormGain.

Do You Know How to Manage Risk?

Risk management is probably the most important idea for a trader who uses leverage to understand. Let’s say that you are using 20x leverage, and your entire account’s value is being used to secure the position.

If the account is worth 100 USDT, the position would be worth 2000 USDT. Let’s also suppose that the position is in BTC, and the purchase price of the BTC is $10,000 USD. With 20x leverage 100 USDT would buy 0.2 BTC, and the position would be wiped out with a price movement of just $500 in the BTC price.

The risk of trading with high amounts of leverage is very real, which makes entering the trade with good risk-limiting measures in place a vital part of leveraged trading. Stop-loss orders are probably the most important thing to understand, and choosing levels that maintain your margin account will keep you trading in the long run.

Legging Into a Leveraged Position

One of the best strategies for creating a leveraged position is called ‘legging in’. Instead of opening up a position with all the capital you have in your margin account, you can open a small position, and see if the market goes in your favor.

The biggest advantage to legging into a larger, leveraged position is that if your view on the market is wrong, the amount of money that is lost will be much smaller.

There is no way to know if the markets will rise or fall, but once you hit the stop-loss orders, it will become apparent that you were incorrect. The real question is: how much trading capital do you want to lose when you get the direction of the markets 100% wrong?

It is possible to think of the initial position that you take when legging into the market as a test of your trading hypothesis. Any trader has to have some idea of which direction the market will go when they enter a position, and a small initial position can help to vet the legitimacy of that view.

If the opening position goes the way you hope it will, you can add to the position. It is a very good idea to have a trading plan in place so that you know how much you want to add, and at what level. Adding a lot of leverage as the position moves in your favor can create massive profits, so don’t forget to use take-profit orders to lock in the gains.

Crypto Markets Can be the Perfect Place to Use Leverage

Cryptos tend to be highly directional when they rise or fall in value.

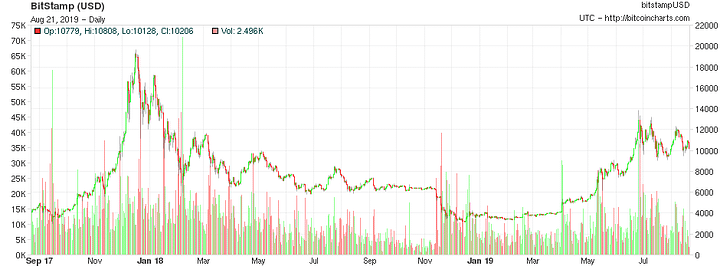

Bitcoin’s rally off its recent lows provides a demonstration of how well-leveraged positions can work in the crypto market. Once BTC blasted out of the trading range it had been stuck in since late 2018, its price ascended rapidly to the $10,000 USD level.

Let’s look at the chart below, and identify some key levels that show how well leverage could work for a crypto trader.

From a trading perspective, BTC’s big blast from the $4,000 USD level in April of 2019 was the time to go bigger into a leveraged trade.

Everyone wants to get in at the bottom, but it isn’t likely to happen. Looking for massive breakouts on huge volume is a good way to spot a turn in the market, and that is exactly what happened when BTC broke out from $4,000 USD to $5,000 on some of the highest trading volume of the year.

Get In and Hold On

If we look at the time period between April and May of 2019, it is easy to see a perfect place to enter a rising market. BTC prices didn’t fall much below $5,000 during that time period, and they didn’t rise over the $5,500 handle by a significant amount.

Using leverage means getting the entry point to a trade correct. If a trader bought into BTC between $5,000 and $5,500 and then added to their position as the market moved up, the result would be massive profits. There is no way to know that a market will rise. By using a legging strategy the losses are minimized, and traders are able to confirm that the market is indeed rising.

As a position appreciates in value, the amount of leverage that can be used increases as well. Because StormGain allows the use of leverage up to 100x deposited capital, for every $1 USDT in value that a position appreciates, an additional $100 USDT can be added to a trade.

Looking at the chart above shows us that once BTC prices once again broke higher on massive volume in mid-May of this year, any positions established at lower levels would have shot up in value, and were also immune from lower prices that would have triggered stop-loss orders.

Conclusion

StormGain is one in a handful of crypto futures brokers that offer high leverage crypto trading. There are numerous options for crypto trading, but the options dwindle as the option of high leverage is added to the list of desired features.

One of the best parts about the StormGain platform is the host of advanced trading features that the company includes with every account. Not only does the platform support limit orders, it also gives its clients free AI-generated trade signals.

StormGain is also very easy to deal with when it comes to opening an account. There are no barriers to trading with StormGain, even if you live in a country that normally isn’t supported by other exchanges. All you need is 50 USDT, and email address, and you are all set.

The only real downside to the platform is that it hasn’t been around for as long as many of the other major exchanges. This may or may not be important to you, but it is something to consider. There are other crypto exchanges that offer high-leverage trading and have a longer track record of providing brokerage services to their clients.

StormGain is also offering a free crypto wallet to the public. The StormGain wallet can be used by anyone, even if they don’t want to trade on the platform. A free, fully-featured, crypto wallet is a great offer and adds to the company’s positive reputation.

Comments

Post a Comment